Residential aged care changes: What they could mean for you

- Wallis-Smith Financial Planning

- Aug 21, 2025

- 7 min read

Updated: Sep 8, 2025

This article was issued by MLC on 16 June 2025.

The Government legislated changes to support ageing Australians at home and in residential aged care services. Most changes apply from 1 November 2025.

Overview

Why are the changes happening?

With the number of Australians over the age of 80 expected to triple over the next 40 years, the sustainability of the aged care industry is under threat. In 2022/23, 46% of aged care providers made a loss from aged care accommodation.1

In 2023, the Aged Care Taskforce was established to explore these issues and made recommendations on how to improve the sustainability of the sector. Their final report was released in March 2024 where a number of recommendations were made for the Government’s consideration. The legislated changes adopt several of the Aged Care Taskforce recommendations. At a high level, these changes seek to ensure that those who can afford to contribute towards the cost of their care do so. Government support will be targeted to those who are not as financially secure. The changes also seek to increase investment in the aged care sector to improve the facilities available to residents.

Will the changes impact me if I'm already in residential aged care?

The changes will only impact new aged care residents entering care from 1 November 2025. The ‘no worse off’ principle ensures that if you’re receiving care before 1 November 2025, your fees will continue to be determined under the existing rules, unless you move to a new aged care provider and choose to be under the new rules.

Note: The Government originally intended for the changes to commence from 1 July 2025 but this has been deferred until 1 November 2025 to allow care providers and care recipients more time to understand the changes.

Will the changes to fees impact private aged care facilities?

Private aged care facilities are not governed by the aged care rules that apply to Government subsidised aged care facilities. Instead, the fees are agreed between you and the private facility. Therefore, the changes to fees do not impact private aged care providers.

Will the changes increase the cost of residential care?

If your income and/or assets exceed certain levels, you may need to contribute more to your care costs if you enter care after 1 November 2025.

The Government expects that half of all new residents entering residential care from 1 November 2025 won’t pay more under the new system. Specifically:

no ‘fully supported’ resident will contribute more.

7 in 10 receiving the full Age Pension will not contribute more, and

1 in 4 part Age Pensioners will not contribute more.

*A fully supported resident is someone who has income and assets below set thresholds and is eligible to have their accommodation fee and most of their ongoing care fees covered by the Government.

Can you give me any case study comparisons to help me understand how much fees could change from 1 November 2025?

The Government released handouts with case studies that show how the fee contribution may change for people who are full Age Pensioners, part Age pensioners, and self-funded retirees. You can access these case studies by clicking here.

Please be aware that the Government released a range of supporting materials prior to the decision to defer the commencement date until 1 November 2025. This means that some publications may still make reference to a 1 July 2025 start date.

Will the Government still contribute to the cost of aged care?

Yes, the Government will continue to pay most of the aged care costs for all aged care residents. However, the amount that they will contribute for each person will change to ensure that those who need financial support the most can access aged care services in a sustainable way.

The amount you will contribute towards the cost of your care, and the amount that the Government will contribute on your behalf will be determined based on your circumstances at the time you enter care, and some fees, may vary after you enter care because of indexation and changes to your financial circumstances. Services Australia and/or the Department of Veterans’ Affairs (DVA) will calculate the Government support that you’re eligible for (paid directly to the facility as a subsidy) when you complete the assessment process at or just before entry to care and monthly thereafter.

Should I aim to enter care before 1 November 2025?

There are many considerations when determining the right time to enter care, including:

completing the assessment process to confirm that you’re eligible for support in a residential aged care facility (based on factors such as your health, mobility and support needs), and

availability of the room of your choice at a facility that meets your needs (including any lifestyle, care, religious, cultural or geographical needs).

Moving into residential aged care is a significant change for many people and it can be an emotional time for everyone involved without making rushed decisions. Often, a lot of planning is required. You may optimise your overall outcomes by seeking advice from professionals such as financial advisers, accountants and solicitors to ensure that all your affairs are in order.

It’s also important to consider that the Government is expanding the ‘Support at Home’ program, to assist ageing Australians to stay in their homes longer. Support will be available for differing levels of care and support needs and can be an option to help you retain your independence at home.

Before you make any decisions, it’s important to talk to someone about your circumstances and how these changes could impact you financially and your lifestyle.

Residential aged care fees

At a glance, what’s changing?

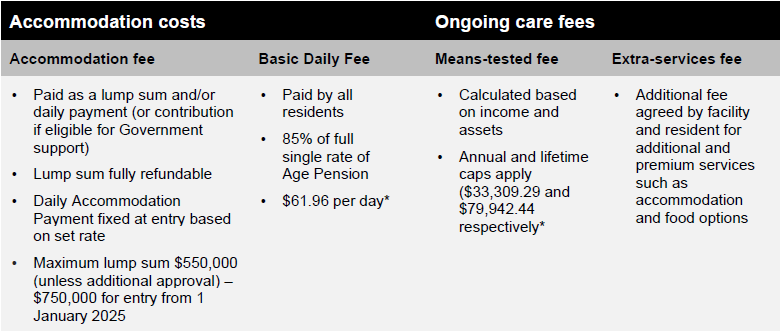

Residential care fees consist of ‘accommodation fees’ and ‘ongoing care fees’. The changes impact both.

What’s an accommodation fee?

You can think of the accommodation fee as the cost of the room. You can choose to pay this fee as a refundable lump sum (often referred to as a ‘bond’ or ‘refundable accommodation deposit’ or ‘RAD’). Alternatively, it may be paid as a non-refundable daily fee (referred to as a ‘daily accommodation payment or contribution’).

Currently, when you leave aged care, any refundable lump sum that you’ve paid is refunded (less any other fees that you’ve agreed to have debited from the amount).

While there’s no limit on the lump sum fee that can be charged for a room, there is a limit on the amount that a facility can charge you for a room without getting specific approval from the Aged Care Pricing Authority.

Changes to accommodation fees

Changes to the accommodation fee include:

increasing the maximum RAD that a facility can charge without approval to keep up with inflation.

introducing a ‘retention amount’ that allows aged care providers to retain an amount of any lump sum paid (reducing the amount refunded when you leave the facility) for up to five years, and

allowing certain daily fees to be adjusted during your stay in care to keep up with rising costs.

What are ongoing care fees?

Ongoing care fees cover the daily costs of your ongoing care. This includes the cost of meals, bathing, and services that may be provided during your stay. You can learn more about these fees in the graphic below.

Changes to ongoing care fees

Changes to ongoing fees include:

the introduction of a ‘Hotelling Contribution’ if you have income and assets above a set limit as a contribution to the cost of hotelling services, and

replacing the current ‘Means-tested Fee’ with a ‘Non-Clinical Care Contribution’. The Government will pay the full cost of any clinical care provided for all residents.

The following tables compares the current fees you may need to pay compared to those for new residents from 1 November 2025. The rates and thresholds as at 1 July 2024, subject to indexation before 1 November 2025.

Pre 1 November 2025

Post 1 November 2025 Entry

Can you explain the changes to lump sum refundable accommodation fees in more detail?Currently, any lump sum paid is fully refundable (unless you authorise the facility to deduct other fees from the deposit). From 1 November 2025, facilities will charge a ‘retention amount’, which means 2% per year (for a maximum of five years) will be deducted from any refundable lump sum deposit you pay to the facility. This will be calculated daily and deducted from the lump sum no more than monthly.

Maximum lump sum accommodation deposit (RAD) increasing

The maximum amount that a facility can currently charge as a RAD without special approval from the Aged Care Pricing Authority is $550,000. This amount has not been indexed or adjusted to account for inflation or the rising costs of construction since 2014. The Aged Care Pricing Authority can change this amount at any time. Many facilities charge more than this amount for certain rooms, however the requirement to receive additional approval can be time consuming. Since 1 January 2025, the maximum amount of RAD that can be charged without specific approval from the Pricing Authority increased to $750,000 and will be indexed on 1 July each year.

Will I be asked to top up my RAD if I am already in care and my provider increases their room prices?

If you’re living in residential aged care before 1 January 2025, the RAD already agreed between you and your provider will not change, as it was set in your Accommodation Agreement at the time you entered care. Facilities can only re-price rooms for new residents from 1 January 2025.

Will there be rooms cheaper than $750,000?

The change will only impact the maximum fee that can be charged, and facilities can still offer rooms at a range of lower prices, as they do today. Often, facilities provide several different room options, priced according to their features (such as private facilities, location on the premises, and whether the room is shared for example).

What will be the process to work out whether I must pay the new Hotelling Contribution or Non-clinical care contribution?

At the time you enter care, an assessment will be completed where any contribution you must pay will be calculated based on your income and assets (for aged care purposes). Similar to the current process, Services Australia/DVA will facilitate this assessment. If you’re a member of a couple, the assessment will include 50% of your and your spouse’s combined income and assets.

Where to next?

Most changes will commence from 1 November 2025. Understanding the aged care system, as well as the interaction with social security and other rules is complex. A financial adviser can help you to understand your options and how these changes may impact you.

Reference

Important information and disclaimer

© 2025 IOOF Service Co Pty Ltd. All rights reserved.

The information in this communication is factual in nature. It reflects our understanding of existing legislation, proposed legislation, rulings, etc., as of the date of issue and may be subject to change. While we believe the information is accurate and reliable, this is not guaranteed. Examples are illustrative and subject to the assumptions and qualifications disclosed. While care has been taken in preparing the content, no liability is accepted for any errors or omissions in this communication and/or losses or liabilities arising from any reliance on this communication.